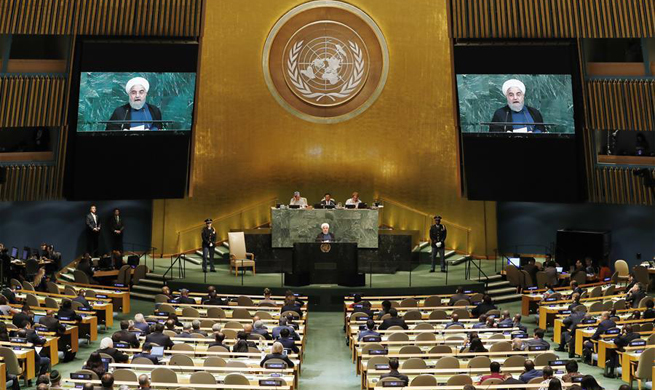

NEW YORK, Sept. 20 (Xinhua) -- Supporting the United Nations Sustainable Development Goals (SDGs) is no window dressing but a great business opportunity, business leaders said here on Wednesday at a forum.

While the international community has made arguably slow progress two years after the UN set ambitious targets for reducing poverty and improving health across the world by 2030, many companies have embraced the targets by investing in areas such as clean energy, green products and sharing economy, and profited from it.

"SINGLE BIGGEST BUSINESS OPPORTUNITY"

The participants at Bloomberg Global Business Forum said their business models are in line with UN SDGs.

Paul Polman, CEO of Unilever, said the main reason to support UN SDGs is that business cannot succeed if society doesn't succeed; nor can business be a bystander in a system that gives it life in the first place.

"We're seeing inequality go up. We see the increasing effects of planetary boundaries. We see too many people being left behind. It's affecting all of our business models," Polman said.

Everyone should contribute to eradicating poverty irreversibly in a more sustainable and equitable way, he said; otherwise, society wouldn't function.

The world is getting to a point where the cost of not acting right now on issues like climate change and biodiversity protection is starting to exceed the cost of acting, he added.

Anand Mahindra, chairman of the Indian conglomerate Mahindra Group, said, "This is not a trade-off. This is the single biggest business opportunity for the next couple of decades."

The group's businesses include micro irrigation and electric vehicles.

Mahindra said Washington's decision to step out of the Paris Agreement is unfortunate because that means the United States will miss growth opportunities.

"Speaking from a competitive point of view, we are delighted if somebody's not going to look at these opportunities. They'll be all there for us," Mahindra said.

Echoing Mahindra, Arif Naqvi, founder and CEO of The Abraaj Group, a private equity investor, said companies can do good while making money and do both extremely effectively.

"You cannot be an island of excellence in an ocean of turbulence. And what we are seeing out there is a lot of frothy water," Naqvi said.

REDEFINING VALUE, RISK

The business leaders also pointed out the importance of companies making financial, environmental and social capital equally important.

Admitting that changing the current financial system will be difficult, Polman said redefining value is the key.

"If we put a price on environmental equity, like for example, a price on carbon, people will actually start to behave differently; and the same thing for social capital," he said.

He added that the industry has to set common standards and it's better to do that quickly.

Commenting on the long-term perspective for the financial markets, Polman said it requires a change of incentive systems such as the way CEOs are compensated.

It also requires clarity on what the fiduciary duties of companies are, and probably some regulatory interventions as well, he added.

Naqvi proposed redefining risk because companies have looked at risk through a very narrow lens and had stereotypes of certain markets and countries.

"What very few people realize is (that) the default rate on projects and infrastructure business in North America is 8.9 percent; in Africa it's 1.1 percent," he pointed out.