WASHINGTON, July 5 (Xinhua) -- International Monetary Fund on Wednesday called on G20 members to reduce excess external imbalances in order to make global economic recovery more resilient.

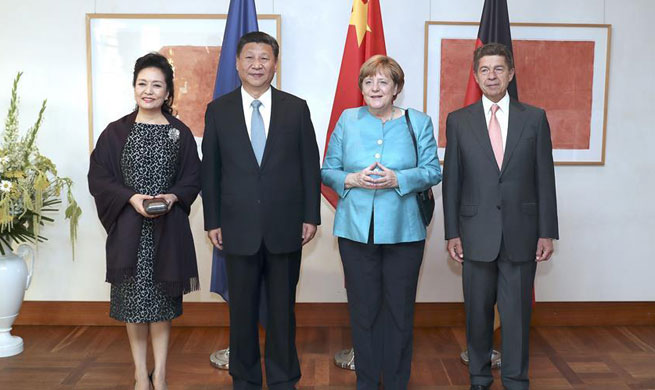

"The global recovery remains on track. However, some of the forces driving the recovery are adding to already high vulnerabilities and external imbalances," said the IMF in a surveillance note released before the G20 summit kicks off on Friday in Hamburg, Germany.

According to the research note, IMF considered the progress in reducing excess current account imbalances in systemic economies has stalled in recent years.

It acknowledged that large and persistent imbalances can add to strains on the multilateral trading system.

Countries with excess current account surplus, such as Germany and South Korea, should use fiscal policy to boost public investment or domestic demand, while excess-deficit economies, such as United States and the United Kingdom, should take measures to consolidate their fiscal conditions, according to the note.

"Both surplus and deficit countries should confront this problem now to avoid larger corrections down the road," IMF Managing Director Christine Lagarde said in a blog on Wednesday.

"This summit is also a chance to strengthen the global trading system and reaffirm our commitment to well-enforced rules that promote competition while creating a level playing field," said Lagarde.

The IMF gave an optimistic assessment of the global economy in the research note. "Growth outturns in the first quarter and high-frequency data generally confirmed a strengthening of global activity, supported by a cyclical upturn in manufacturing, investment, and stronger trade growth," said the IMF.

It said that current economic data suggested a broadly similar outlook compared to its April World Economic Outlook report. In April, it forecast the global economy to grow 3.5 percent in 2017 and 2018 after 3.1 percent growth in 2016.

However, it also warned of rising financial vulnerabilities. Emerging markets continued to see increased corporate leverage and bank vulnerabilities, and many advanced economies continued to experience restricted financial sector profitability due to very low interest rates and high levels of non-performing loans.