BEIJING, Oct. 1 (Xinhua) -- A year has passed since the Chinese currency renminbi, or the yuan joined the IMF Special Drawing Right (SDR) basket. While the impact of the move may appear limited, the currency has taken steady steps on its global march.

On Oct. 1, 2016, the RMB became the fifth currency in the basket, joining the U.S. dollar, euro, Japanese yen and British pound.

Created by the IMF in 1969, the SDR is an international reserve asset to supplement members' official reserves. It can be exchanged among governments for freely usable currency in times of need.

The U.S. dollar has a weighting of 41.73 percent in the new basket, 30.93 percent for the euro, 10.92 percent for the yuan, 8.33 percent for the Japanese yen and 8.09 percent for the British pound.

Over the past year, multi-pronged efforts have encouraged global use of the yuan. Here are some of the milestones of the yuan's progress toward internationalization.

-- Yuan trade accounted for 1.94 percent of all transactions made through the Society for Worldwide Interbank Financial Telecommunication (SWIFT) in August, the fifth most-traded currency.

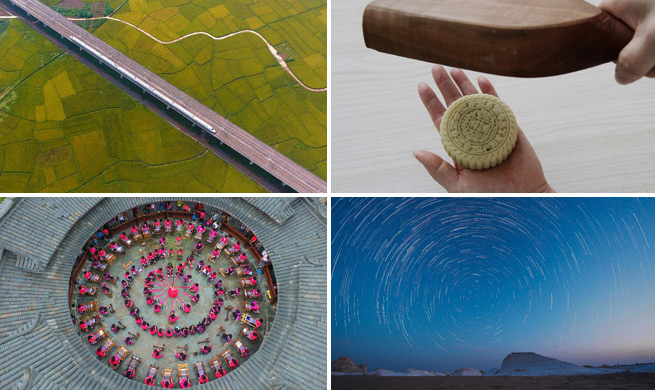

-- Following the launch of the Shanghai-Hong Kong stock link in 2014, the Shenzhen-Hong Kong stock connect started trading in December 2016, gradually internationalizing the capital market.

-- A Bond Connect between the Chinese mainland and Hong Kong began this July, allowing investors from both sides to trade bonds on each other's interbank markets. Foreign institutions increased their holdings of yuan-denominated bonds by a record 82.6 billion yuan (about 12.4 billion U.S. dollars) in August.

-- Global equity indexes provider MSCI announced in June this year that it will include China A-shares in the MSCI Emerging Markets (EM) Index and the MSCI ACWI (All Country World Index) Index, from June 2018.

-- In May this year, a change was made in the way the yuan-U.S. dollar central parity rate was calculated, allowing dealers to incorporate a "counter cyclical factor" into the mechanism. The adjustment endeavors to keep exchange rates stable at a time when global financial markets remain beset by instability.

-- Outward-looking strategies including the Belt and Road Initiative are expected to increase the use of the RMB for project funding.

Since 2013, the initiative has delivered real benefits to countries along the routes. From Mongolia to Malaysia, Thailand to Pakistan and Laos to Uzbekistan, many projects, including high-speed railways, bridges, ports, industrial parks, oil pipelines and power grids, are being built.