International Monetary Fund (IMF) Managing Director Christine Lagarde speaks on launch of the new Special Drawing Right (SDR) basket including the Chinese currency, the renminbi (RMB) in Washington D.C., the United States, Sept. 30, 2016. IMF on Friday announced the launch of the new SDR basket including the Chinese RMB, saying it was "an important and historic milestone" for China, the IMF and the international monetary system. (Xinhua/Yin Bogu)

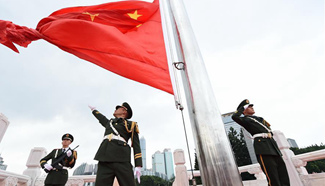

GUANGZHOU, Oct. 1 (Xinhua) -- The Renminbi's inclusion into the elite reserve currency basket of the International Monetary Fund (IMF) on Saturday was hailed by Chinese businesses and analysts as a "historic moment".

"This is a historic moment," said Lu Jian, vice president of Guangdong Guangken Rubber Group Co., Ltd.

"Ten years ago, the RMB could hardly 'go out of the country'. But now China's opening-up and huge economic size has made it more and more popular in the international market," said Lu.

Early this year, Guangken Rubber launched a 270-million-U.S.-dollar bid for Thailand's Thai Hua Rubber, the world's third-largest rubber producer.

The company then sought loans from domestic and overseas banks, with some offering to fund its bid all in RMB.

The acquisition in RMB helps reduce foreign exchange risk as well as fund-raising cost, said Lu.

"Ten years ago, all our overseas business was conducted in the U.S. dollars and we often did not have RMB clearing banks. It's quite a different scenario now," he said.

Now China has 21 overseas RMB clearing banks across the world.

"Despite the fluctuations in the RMB exchange rate, the international market has not lost interest in the Chinese yuan and on the contrary, the global demand is increasing," said Lu.

Over the past decade, the world has witnessed the rapid rise of the Chinese currency.

Now, the RMB accounts for the third-largest share of the new SDR basket with 10.92 percent, following the U.S. dollar's 41.73 percent and the Euro's 30.93 percent.

"While in college, I never expected that the yuan would become such an important international currency one day," said 31-year-old Xuan Fangyu in Shenzhen.

Xuan works for Hytera, conducting foreign exchange derivatives to help the telecom equipment maker avoid foreign exchange losses.

Xuan said she earlier advised overseas customers to settle in RMB when the Chinese currency appreciated against the U.S. dollar.

"In the earlier period, customers did not trust RMB and were not willing to accept yuan settlement," said Xuan. "But over the past two years, things have changed and many customers, particularly those from the southeast Asia, even proposed to settle in yuan themselves."

In July 2009, China approved pilot program for cross-border trade settlement in RMB, embarking on the internationalization process of the Chinese currency.

The yuan was the fifth most active currency for global payments by value in July, with a share of 1.9 percent, an increase from 1.72 percent in June, according to data from global transaction services organization SWIFT.

China's central bank said on Saturday that the country will continue to push forward financial reforms and market opening after the RMB's SDR inclusion. The SDR is an international reserve asset created by the IMF in 1969 to supplement its member countries' official reserves. It can be exchanged among governments for freely usable currencies in times of need.

Last November, the IMF decided to include the yuan in the SDR basket as a fifth currency, effective Oct. 1, 2016.

Zhang Lijun, a partner with PricewaterhouseCoopers China, said the RMB's SDR inclusion has similar significance with China's entry to the World Trade Organization.

"The two cases also have showed that China helped to improve rather than topple global rules and this has positive significance for the coordination of global economic governance," said Zhang.